WELLS FARGO ONLINE ROUTING NUMBER MOD

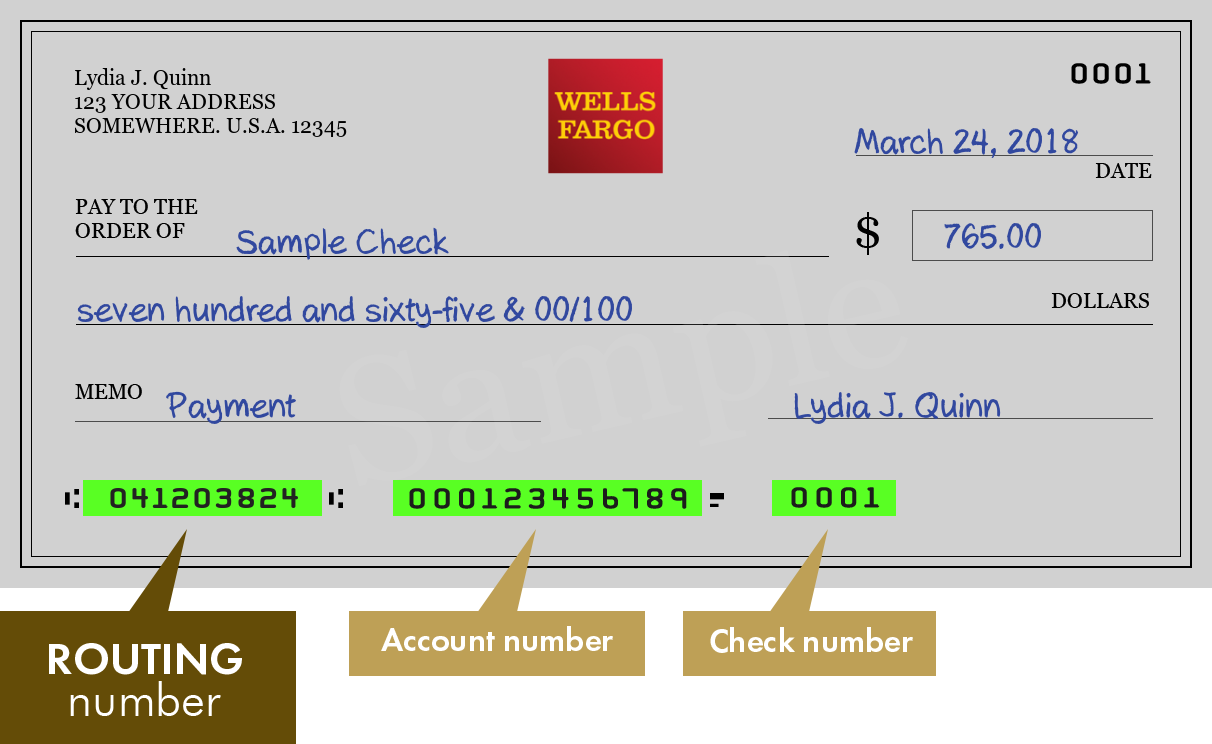

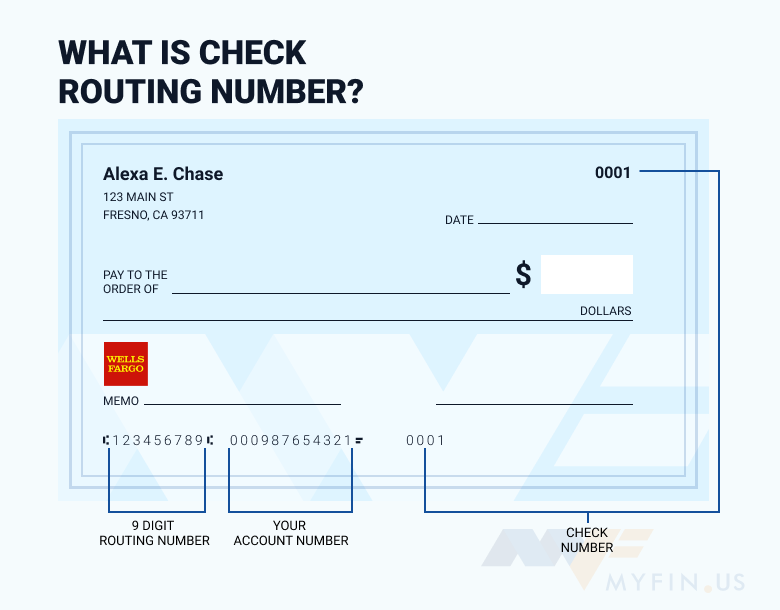

This condition is mainly intended to reduce misrouting errors typically due to input errors.ģ(d1+d4+d7) + 7(d2+d5+d8) + (d3+d6+d9) mod 10 = 0įor example, 111000038 is the routing number of the Federal Reserve Bank in Minneapolis.Ĥ0 mod 10 is 0, so the check digit condition was met. The check digit is the ninth digit of the routing number and must meet the following condition. Aside from 80, the first two digits can be associated with the 12 Federal Reserve Banks: Primary (01-12) 61 - 72 are special purpose numbers for non-bank payment processors and clearinghouses and are termed Electronic Transaction Identifiers (ETIs). Within these ranges, 21 - 32 are assigned to thrift institutions only, such as credit unions and savings banks. Within the 4 digit Federal Reserve Routing Symbol, the first two digits can only be 00 - 12, 21 - 32, 61 - 72, or 80. Where XXXX is Federal Reserve Routing Symbol, YYYY is the Financial Institution Identifier, and C is the Check Digit. In MICR form, the routing number is in the form of MICR form is the more commonly used form, and it is very rare to see the fraction form as of 2020. Essentially, they contain the same information. The routing number can have two forms-fraction form and MICR (magnetic ink character recognition) form. You can also find routing numbers on the websites of most financial institutions or by calling them directly.

The Routing Number Lookup tool can help verify the Routing Number is associated with a specific financial institution. Therefore, it is very important to double check and use the correct routing number before making a money transfer.

WELLS FARGO ONLINE ROUTING NUMBER CODE

Canadian numbers are eighth-digit codes consist of FIN code - 3 digits long and the Transit Number - 5 digit long used in EFT payments and managed by Canadian Payments Association (CPA).

Difference betweeen USA and Canada bank routing number is length, payment schemes and management institutions. Some financial institutions may also assign routing numbers for specific regions or specific types of accounts, such as a business account.

The banks or credit unions that have multiple routing numbers may use different routing numbers for different purposes.įor example, some routing numbers are dedicated for use with Fedwire only, and cannot be used for ACH transfers. However, in reality, many institutions have more than 100 routing numbers due to mergers or acquisitions. Each financial institution can theoretically apply for up to 5 routing numbers according to policy.

0 kommentar(er)

0 kommentar(er)